Bán bóng bay Hidro (Xem tất cả)

-

Bóng bay kích nổ khai trương

Giá Liên Hệ

Mua ngay Chi tiết

-

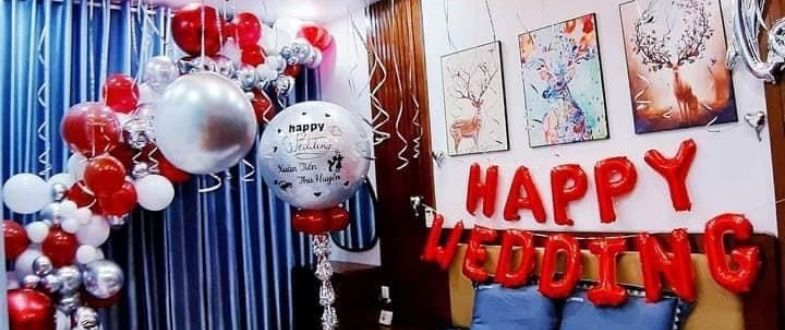

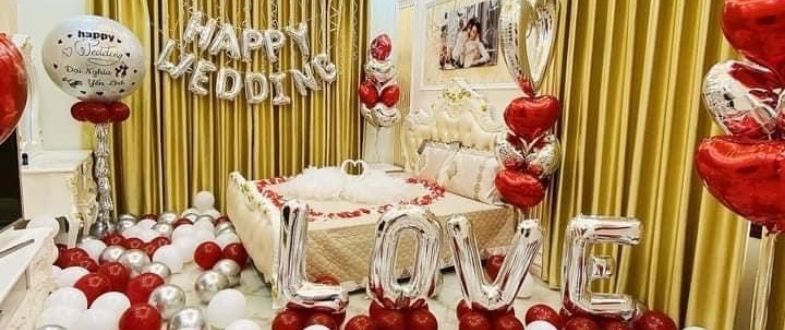

Bóng bay kích nổ đám cưới

Giá 800.000 VNĐ

Mua ngay Chi tiết

-

Bóng Bay Kích Nổ Hà Nội

Giá 999 VNĐ

Mua ngay Chi tiết

-

Bóng Bay Khai Trương Hà Nội

Giá Liên Hệ

Mua ngay Chi tiết

-

Cổng Bóng Bay Khai Trương

Giá Liên Hệ

Mua ngay Chi tiết

-

Bóng Bay Trang Trí Khai Trương

Giá Liên Hệ

Mua ngay Chi tiết

Bán Bóng bay kỷ yếu (Xem tất cả)

-

Bóng Bay Trang Trí Lớp Học Lễ Tốt Nghiệp Bế Giảng Y99+ TẶNG KÈM SỐ THEO YÊU CẦU

Giá 270.000 VNĐ

Mua ngay Chi tiết

-

Bán Thanh Đập Cổ Vũ

Giá Liên Hệ

Mua ngay Chi tiết

-

Kết cổng bóng bay

Giá Liên Hệ

Mua ngay Chi tiết

-

Bóng bay giao tận nhà 5000đ

Giá 5.000 VNĐ

Mua ngay Chi tiết

-

Bán bóng bay nhũ

Giá 7.000 VNĐ

Mua ngay Chi tiết

-

Bán bóng bay tim nilong

Giá 10.000 VNĐ

Mua ngay Chi tiết

Cổng bóng bay (Xem tất cả)

-

Bóng Bay Khai Trương

Giá Liên Hệ

Mua ngay Chi tiết

-

Kết cổng vòm bóng bay

Giá Liên Hệ

Mua ngay Chi tiết

-

Làm cổng bóng bay giá rẻ

Giá Liên Hệ

Mua ngay Chi tiết

-

Trang trí phông bóng bay

Giá 80.000 VNĐ

Mua ngay Chi tiết

-

Trang trí backdrop bằng bóng bay

Giá 80.000 VNĐ

Mua ngay Chi tiết

-

Kết cổng bóng bay nghệ thuật

Giá Liên Hệ

Mua ngay Chi tiết

Bán Bóng Bay Sinh Nhật (Xem tất cả)

-

Bóng bay kích nổ đám cưới

Giá 800.000 VNĐ

Mua ngay Chi tiết

-

Bóng Bay Kích Nổ Hà Nội

Giá 999 VNĐ

Mua ngay Chi tiết

-

Bộ Trang Trí Sinh Nhật Tại Nhà MJ4

Giá Liên Hệ

Mua ngay Chi tiết

-

Bộ Bóng Trang Trí Sinh Nhật MM088

Giá Liên Hệ

Mua ngay Chi tiết

-

Combo Bóng Bay Sinh Nhật Cho Người LớnTại Nhà HP02

Giá Liên Hệ

Mua ngay Chi tiết

-

Set Bóng Bay Trang Trí Sinh Nhật Tại Nhà Hàng MM06

Giá Liên Hệ

Mua ngay Chi tiết

Bóng bay nghệ thuật (Xem tất cả)

-

Bóng bay giun vặn hình nghệ thuật

Giá 80.000 VNĐ

Mua ngay Chi tiết

-

Bộ 100 bóng bay tạo hình nghệ thuật, bóng giun

Giá 80.000 VNĐ

Mua ngay Chi tiết

-

Bóng bay giun thái lan

Giá 80.000 VNĐ

Mua ngay Chi tiết

-

Bóng bay giun màu hồng- vặn hình nghệ thuật

Giá 80.000 VNĐ

Mua ngay Chi tiết

-

Bộ 100 Bong Bóng Tạo Hình Nghệ Thuật + Dụng Cụ Bơm

Giá 99.000 VNĐ

Mua ngay Chi tiết

-

BÓNG BAY JUMBO TRANG TRÍ SINH NHẬT CHO NGƯỜI LỚN

Giá 300.000 VNĐ

Mua ngay Chi tiết